GCP – Making transactions and banking more transparent with Google Maps Platform

Editor’s note: Today’s post is a Q&A with Ken Hart, CEO of Snowdrop Solutions. Snowdrop Solutions is a Google Cloud Premier Partner that started working with Google Maps Platform in early 2014 in Europe and recently expanded into Asia working with Standard Chartered Bank.

Why is location such a critical part of the solutions you’ve developed to support your financial services customers?

Showing people where they spend their money is key to resolving doubts and anxieties they may have about how and where they spend. Also, we work with other location-based use cases such as onboarding of new digital customers and early detection of fraud. In all of these steps, deep location data and expertise is a key part of the overall puzzle of building a transformative digital banking experience based on transparency, trust, and customer delight. Understanding where and how they spend their money is at the heart of what customers are now requiring from their bank.

Why did Snowdrop Solutions decide to create solutions to support the financial services industry and what were some of the early challenges your customers were facing?

About three years ago we began to work closely with several leading digital banks based in the UK. We saw that the challenges faced by these companies were related to the user experience. Many users did not understand their banking transactions because they were listed by transaction codes and IDs, which are not intuitive to consumers as they’re not based on actual merchant names and locations. This required the consumer to contact their bank’s customer service center in search of explanations about individual transactions. We knew we could help improve the quality and richness of the transaction data, help reduce the inquiries to call centers, and in return help to reduce their overall costs.

Describe Snowdrop’s Merchant Reconciliation System (“MRS”) and how your customers benefit.

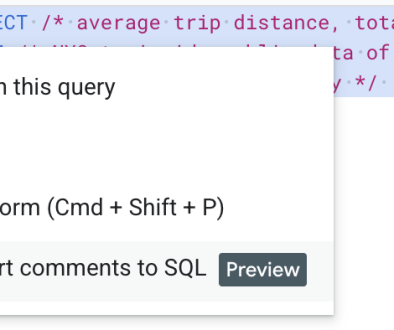

MRS is built on Google Maps Platform and takes messy transaction data from the banks and ‘cleans’ it, providing an easy-to-use and easy-to-understand list of merchant transactions including the merchant logo, merchant name, and merchant website. Using the Places and Maps APIs, MRS offers customers an expanded view of each transaction–with rich local data like business name, 360-degree interactive Street View imagery of the business, and the location of the transaction on a Google map. This gives customers the confidence that their card transactions are correct and reduces customer service calls and transaction disputes.

Tell us about some of your early adopter customers in this sector and why they turned to Snowdrop Solutions to help them launch their services.

One or our early customers, Dozens, wanted to benefit from the work already done through our MRS to launch a differentiated customer experience. Their goal is to help people spend and save money smarter. So they chose to work with Snowdrop because they wanted to be among the first to market with better spending insights. By leveraging Snowdrop’s MRS product and expertise, they were able to launch quickly to give its customers an in-depth understanding of how much, where, when, and how they spend money. To do this, they integrated rich Places data from Google Maps Platform into the app. This helps customers visualize transaction location data and gives customers context for their spending, allowing them to not only understand their habits and trends, but also reduce anxiety around potential fraud and misuse of financial products.

Have you seen a difference between how some of the new startup fintech companies have embraced your solution versus traditional financial services companies?

The digital banks–sometimes referred to as “challenger banks” or “neo-banks”–are in a position to be much more agile because they’re building their solutions from the ground up. Often they have a clear value proposition and believe that a better consumer experience is the cornerstone of their service. Traditional banks need to take into account their legacy IT infrastructure which means they have more requirements to consider to access and provide the data needed to fuel innovative new customer experiences or integrate new technologies.

Digital banks are usually more pragmatic, agile and really focused on improving the customer experience. Often they recognise that not everything should be built from scratch in-house.

Tell us about what Standard Chartered Bank (SCB) was looking to achieve by partnering with Snowdrop Solutions and how they’re going to benefit from the solution.

As an innovative bank, SCB is keen to put a better consumer experience at the forefront of their services and lead in the Singapore market through innovation and rapid adoption of the best practices developed in part by London-based challenger banks. So, they partnered with us to launch Standard Chartered Places (SC Locate), a new banking enhancement built with MRS and Google Maps Platform that maps out where users spend their money. SC Locate will enable the bank’s retail clients to visualize their expenses in an interactive and intuitive way on its digital banking platforms. A first in Singapore, this new enhancement turns confusing transaction information into clean, easily identifiable places shown on a Google map with real-time notifications, includes related logos and categories for major brands, including both on-line and in-store merchants, and enables customers to see their spending habits and recognize transactions even when traveling abroad.

Why did you decide to expand into the Singapore market and why was this so important in the region?

From the point of view of the banks, Singapore is a banking hub where it was clear more insights into transaction data could make an impact with their customers. The inherent benefits of location data tied to transactions provide a point of differentiation in a market where there are currently a small number of dominant players offering banking services.

From the point of view of Singapore banking customers, they’ll benefit from a better banking experience. Key to this is reduced anxiety from difficult to recognise transactions. Of course, it should be noted that these benefits are not exclusively for Singapore. There are many major financial hubs in Asia and around the world that would benefit. Since Google Maps Platform provides rich location data for more than 200 million places worldwide, MRS can support baking customers and consumers worldwide as well. Singapore, like London, is a leading financial hub. What happens in these two key cities is often propagated through the surrounding regions over the following years.

Over the next 3 to 5 years, where do you see how your fintech customers are leveraging location data headed?

We believe that digital banking is still in its infancy. As mobile and cloud computing technologies continue to grow, and more and more location-based datasets become interconnected, Snowdrop will continue working with Google Maps Platform and an expanding range of products and services that help consumers see and do things differently. In the past, a bank statement was a simple, static PDF. With the rich location data provided through Google Maps Platform, it is now a place where customers can start saving, sharing, and getting financial recommendations across the globe.

We are having a number of interesting discussions with our customers but will have to leave you in suspense for the moment!

For more information on Google Maps Platform, visit our website.

Read More for the details.