GCP – Lending DocAI fast tracks the home loan process

Artificial intelligence (AI) continues to transform industries across the globe, and business decision makers of all kinds are taking notice. One example is the mortgage industry; lending institutions like banks and mortgage brokers process hundreds of pages of borrower paperwork for every loan – a heavily manual process that adds thousands of dollars to the cost of issuing a loan. In this industry, borrowers and lenders have high expectations; they want a mortgage document processing solution catered to improving operational efficiency, while ensuring speed and data accuracy. They also want a document automation process that helps enhance their current security and compliance posture.

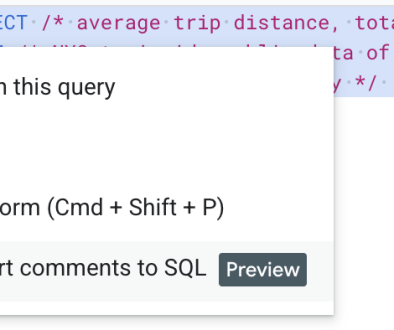

At Google, our goal to understand and synthesize the content of the world wide web has given us unparalleled capabilities in extracting structured data from unstructured sources. Through Document AI, we’ve started bringing this technology to some of the largest enterprise content problems in the world. And with Lending DocAI, now in preview, we’re delivering our first vertically specialized solution in this realm.

Lending DocAI is a specialized solution in our Document AI portfolio for the mortgage industry. Unlike more generalized competitive offerings, Lending DocAI provides industry-leading data accuracy for documents relevant to lending. It processes borrowers’ income and asset documents to speed-up loan applications—a notoriously slow and complex process. Lending DocAI leverages a set of specialized models, focused on document types used in mortgage lending, and automates many of the routine document reviews so that mortgage providers can focus on the more value-added decisions. Check out this product demo.

In short, Lending DocAI helps:

-

Increase operational efficiency in the loan process: Speed up the mortgage workflow processes (e.g. loan origination and mortgage servicing) to easily process loans and automate document data capture, while ensuring that accuracy and breadth of different documents (e.g. tax statements, income and asset documents) support enterprise readiness.

-

Improve home loan experience for borrowers and lenders: Transform the home loan experience by reducing the complexity of document process automation. Enable mortgage applications to be more easily processed across all stages of the mortgage lifecycle, and accelerate time to close in the loan process.

-

Support regulatory and compliance requirements: Reduce risk and enhance compliance posture by leveraging a technology stack (e.g. data access controls and transparency, data residency, customer managed encryption keys) that reduces the risk of implementing an AI strategy. It also streamlines data capture in key mortgage processes such as document verification and underwriting.

Partnering to transform your home loan experience

Our Deployed AI approach is about providing useful solutions to solve business challenges, which is why we’re working with a network of partners in different phases of the loan application process. We are excited to partner with Roostify to transform the home loan experience during origination. Roostify makes a point-of-sale digital lending platform that uses Google Cloud Lending DocAI to speed-up mortgage document processing for borrowers and lenders. Roostify has been working with many customers to develop our joint solution, and we have incorporated valuable feedback along the way.

“The mortgage industry is still early in transitioning from traditional, manual processes to digitally-enabled and automated, and we believe that transformation will happen much more quickly with the power of AI. And if you are going to do AI, you’ve got to go Google.” – Rajesh Bhat, Founder and CEO, Roostify

Our goal is to give you the right tools to help borrowers and lenders have a better experience and to close mortgage loans in shorter time frames, benefiting all parties involved. With Lending DocAI, you will reduce mortgage processing time and costs, streamline data capture, and support regulatory and compliance requirements.

Let’s connect

Be sure to tune in to the Mortgage Bankers Association annual convention to learn from our Fireside Chat and session with Roostify!

Read More for the details.