GCP – How banks can build resilience into core systems and accelerate a return to innovation in 2021

Banks have an important role to play in the post-pandemic economic recovery. According to an EY Future Consumer Index study, more than eight out of 10 people are worried about their financial position, and 25% believe it may take years before they return to a state of stability. Banks can help by providing businesses access to critical loans and funding so they can re-open their doors and implement new safety measures post-lockdown, while also offering consumers more personalized services and digital channels that are accessible to all, even those who may find it difficult to bank online.

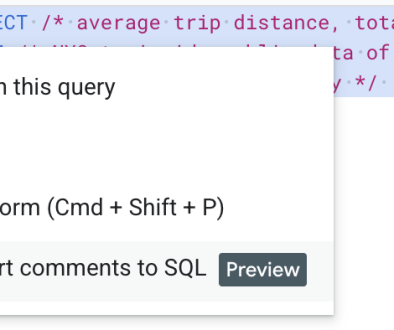

But offering these differentiated services and helping customers bounce back faster means banks also need to focus on building resilience into their systems and accelerate a return to innovation. In the IDC whitepaper Crisis is Accelerating Digital Transformation in Banking, Again, sponsored by Google Cloud and Intel, Jerry Silva, Vice President of IDC Financial Insights, discusses where banks should focus their investments to help speed recovery. He also shares the critical technologies that can help banks return to a position of strength and growth. We’re sharing some key takeaways, and we invite you to read the full whitepaper for more details.

The pandemic exposed weaknesses in critical back-office systems

COVID-19 has challenged many banks to think hard about the resilience of their underlying infrastructure. As a result of social distancing mandates, many people avoided visiting branches, and many branches closed down altogether, placing a heavier burden on core systems and contact centers, which were unprepared to handle the load.

In addition, credit needs significantly increased. Small and mid-sized businesses in particular were impacted by the loss of business that accompanied the pandemic. Banks were then faced with the challenge of having to implement new lending capabilities and handle the heavy increase in loan applications, often with legacy systems that didn’t offer the flexibility nor scalability required.

Even now, according to IDC’s October 2020 COVID-19 Impact on IT Spending Survey, fewer than 20% of financial institutions worldwide say they have “recovered to a new normal.” Modernization of the back office and adoption of cloud for critical banking systems may help improve resilience and deliver the agility needed to adapt to future disruptions.

Banks that invested in digital transformation before COVID-19 have been able to accelerate their recovery

IDC has also studied the different phases of recovery and tracked the progress made by banks across the globe. In IDC’s COVID-19 Impact on IT Spending Survey conducted in July 2020, they found that 89% of banks in North America and 83% of banks in EMEA are still focused on business continuity, cost optimization, and building resilience into their operations. Conversely, 77% banks in the APAC region—where the impact of the virus was felt earlier on—are already accelerating longer term transformational projects and returning to a focus on innovation.

What’s important to consider is that some banks that had already invested in transformation prior to COVID-19 have been able to leapfrog to the later phases of recovery and create a sort of “digital divide” between themselves and other banks that had not prioritized transformation. Watch Jerry Silva, vice president of IDC Financial Insights explain the concept of the “digital divide” in more detail in the Road to Recovery and Growth in Banking webcast.

Technologies that will support the bank of the future

If we’ve learned anything, it is that COVID-19 will further drive adoption of digital technologies and that means banks should also accelerate digital transformation in kind. Leveraging technologies like open APIs, microservices, and flexible deployment models can help banks overcome some critical challenges discussed earlier that had been exposed by the pandemic.

One approach would be for banks to leverage open APIs and microservices to modernize and modularize inflexible, legacy banking systems in order to build new services and capabilities much faster in the future. Google Cloud works with financial institutions to help deliver innovative products and services through open APIs, enabling banks to reach customers through new digital distribution channels.

Additionally, Google Cloud partners with a growing ecosystem of trusted financial services solution providers like Temenos to help banks improve the resilience and agility of mission-critical core banking, front-office and payments applications. For instance, Temenos’s core banking application Transact runs on Anthos, which enables banks to digitally transform applications at their own pace, with the flexibility to manage applications across heterogeneous environments. Banking customers often ask us about solutions to simplify bursting and disaster recovery for critical banking applications across hybrid cloud and multi-cloud environments. Temenos offers a guide that details how Transact core banking can be deployed on Anthos to support these key use cases.

In IDC’s 2020 CloudPath Survey, 89% of banks reported operating with, or planning to operate with hybrid cloud strategies. Silva also states in a recent blog post that “by 2029, a best-in-class bank will be supported by a hybrid architecture consisting of cloud-based infrastructure and partner-provided services to create existing and new sources of value for customers.” Therefore, it’s important for banks to consider solutions that will help simplify orchestration and management of workloads across heterogeneous environments.

The silver lining: crisis is forcing transformation for the better

There can be no doubt that 2020 has been a challenging year for everyone, let alone the banking industry. The silver lining is that banks are continuing to invest in the technology. IDC predicts that the global banking industry will accelerate IT spend over the next five years, growing at 5.9% annually and that investments in cloud will be double that of overall IT spending. With the right digital transformation strategies and solutions in place, the transformed financial institution will be able to deliver better customer experiences, operate more efficiently, and build the resilience to withstand whatever the future brings.

To learn more, read the IDC whitepaper Crisis is Accelerating Digital Transformation in Banking, Again and catch the conversation on the Road to Recovery and Growth in Banking webcast.

Read More for the details.