GCP – How Alpian is redefining private banking for the digital age with gen AI

As the first fully cloud-native private bank in Switzerland, Alpian stands at the forefront of digital innovation in the financial services sector. With its unique model blending personal wealth management and digital convenience, Alpian offers clients a seamless, high-value banking experience.

Through its digital-first approach built on the cloud, Alpian has achieved unprecedented agility, scalability, and compliance capabilities, setting a new standard for private banking in the 21st century. In particular, its use of generative AI gives us a glimpse of the future of banking.

The Challenge: Innovating in a Tightly Regulated Environment

The financial industry is one of the most regulated sectors in the world, and Switzerland’s banking system is no exception. Alpian faced a dual challenge: balancing the need for innovation to provide cutting-edge services while adhering to stringent compliance standards set by the Swiss Financial Market Supervisory Authority (FINMA).

Especially when it came to deploying a new technology like generative AI, the teams at Alpian and Google Cloud knew there was virtually no room for error.

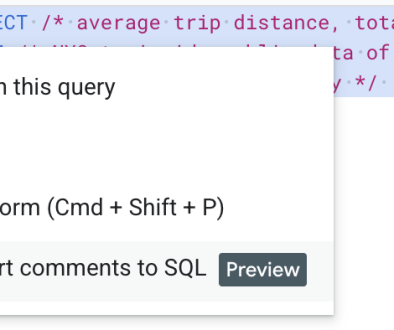

Tools like Gemini have streamlined traditionally complex processes, allowing developers to interact with infrastructure through simple conversational commands. For instance, instead of navigating through multiple repositories and manual configurations, developers can now deploy a new service by simply typing their request into a chat interface.

This approach not only accelerates deployment times — reducing them from days to mere hours — it’s also empowered teams to focus on innovative rather than repetitive tasks.

There are limits, to be sure, both to ensure security and compliance, as well as focus on the part of teams.

Thanks to this platform with generative AI, we haven’t opened the full stack to our engineers, but we have created a defined scope where they can interact with different elements of our IT using a simplified conversational interface. It’s within these boundaries that they have the ability to be autonomous and put AI to work.

Faster deployment times translate directly into better client experiences, offering quicker access to new features like tailored wealth management tools and enhanced security. This integration of generative AI has not only optimized internal workflows but also set a new benchmark for operational excellence in the banking sector.

- aside_block

- <ListValue: [StructValue([(‘title’, ‘Try Google Cloud for free’), (‘body’, <wagtail.rich_text.RichText object at 0x3e0ff9deda60>), (‘btn_text’, ‘Get started for free’), (‘href’, ‘https://console.cloud.google.com/freetrial?redirectPath=/welcome’), (‘image’, None)])]>

A Collaborative Journey to Success

Alpian worked closely with its team at Google Cloud to find just the right solutions to meet it’s evolving needs. Through strong trust, dedicated support and expertise, they were able to optimize infrastructure, implement scalable solutions, and leverage AI-powered tools like Vertex AI and BigQuery.

“Google Cloud’s commitment to security, compliance, and innovation gave us the confidence to break new ground in private banking,” Damien Chambon, head of cloud at Alpian, said.

Key Results

Alpian’s cloud and AI work has already had a meaningful impact on the business:

-

25% faster feature deployment, ensuring quicker time-to-market for innovative banking products.

-

Enhanced developer productivity with platform engineering, enabling more independence and creativity within teams.

-

Automated compliance workflows, aligning seamlessly with FINMA’s rigorous standards.

-

Simplified deployment processes, reducing infrastructure complexity with tools like Gemini

These achievements have enabled Alpian to break down traditional operational silos, empowering cross-functional teams to work in harmony while delivering customer-focused solutions.

Shaping the Future of Private Banking

Alpian’s journey is just beginning. With plans to expand its AI capabilities further, the bank is exploring how tools like machine learning and data analytics can enhance client personalization and operational efficiency. By leveraging insights from customer interactions and integrating them with AI-driven workflows, Alpian aims to refine its offerings continually and remain a leader in the competitive digital banking space.

By aligning technological advancements with regulatory requirements, Alpian is creating a model for the future of banking — one where agility, security, and customer-centricity can come together seamlessly and confidently.

Read More for the details.