GCP – FLUIDEFI nets 3X gains in processing speed with AlloyDB to address DeFi industry challenges

Editor’s Note: FLUIDEFI® is a SaaS platform for institutional investors in the decentralized finance space — a complex industry to navigate because of its volatility, fragmented nature, and lack of clear governance. By providing risk qualification, portfolio modeling, and other services, FLUIDEFI fulfills an important market need. Migrating to AlloyDB has netted FLUIDEFI 3X gains in processing speed and 60% lower cost for a similar instance size.

In the complex world of decentralized finance (DeFi), institutional investors and audit firms face a lack of reliable and standardized real-time data from a recognized authority. Complicating this further is the lack of available risk ratings and audit trails.

Plugging the gap in trusted sources for accurate data, actionable insights, risk rating, and audit trails requires serious number crunching. It takes a massive amount of data collection, storage, and calculations. This is where we step in.

Simplifying crypto — the FLUIDEFI solution

Our platform offers a comprehensive solution that simplifies qualifying risks, building portfolio models, testing investment strategies, tracking investments, and creating auditable financial reports. We do this by using the latest algorithms and risk models to provide real-time data and insights to crypto investors and traders so they can make informed decisions.

We also offer risk rating and audit-trail features that help investors and traders track their investments and monitor their performance over time. These features help them evaluate the effectiveness of their investment strategies and adjust them to optimize their returns.

Our feature-rich solution enables several critical use cases for our customers: decision-making for investing in alternative assets; tracking the performance of these assets through our portfolio manager, data visualizations, and tracking mechanisms; tax reporting; and financial auditing through two independent sources for all verified blockchain (on-chain) transactions.

Why a robust managed database service is critical for us

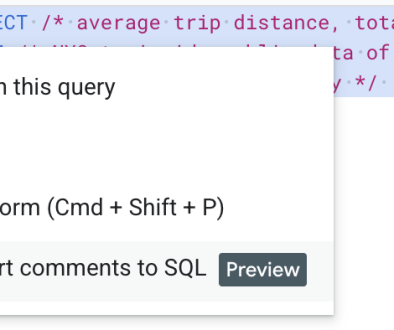

Our solution uses both a graphical user interface (GUI) and RESTful API. We process a massive amount of data — our databases hold over 2 billion records and use more than 40 real-time ingestion/computation services that demand fast response times. To meet the heavy workload demand and to reduce our management overhead with the database infrastructure, we first started with Amazon Aurora. Despite tuning the instances and scaling, we were not able to achieve the throughput from the service that we had hoped for. It was also unable to keep up with the addition of new protocols and chains, and we realized that we would take a hit on both cost and efficiency as we scaled. We considered our options based on the most critical factor — performance on write speed because of the amount of data we ingest on an hourly basis from blockchains, and turned to AlloyDB for PostgreSQL.

Allying with AlloyDB — the benefits of migrating our database

An early proof of concept (POC) gave us complete confidence in AlloyDB as our database of choice. In fact, the POC results were so robust that we followed up with a full migration within weeks of AlloyDB becoming generally available.

Coming from another cloud provider, it was easy and intuitive for our team members to familiarize themselves with Google Cloud services like container management, virtual machines, and AlloyDB. Thanks to Database Migration Service, we managed to migrate all our data with zero downtime for our customers. Additionally, the full compatibility that AlloyDB offers for PostgreSQL also meant that we migrated our app as-is without any code changes, which saved us a lot of time and effort.

We’ve seen a dramatic improvement in terms of cost for the same number of virtual CPUs and memory because we don’t incur any I/O charges with AlloyDB. AlloyDB’s tiered storage and scale-out architecture improved operational performance by meeting or exceeding our throughput expectations. Specifically, our previous cloud database took 23 minutes to recompute a complex materialized view. With AlloyDB, the same materialized view now refreshes in just four minutes while using the same memory and number of CPUs but with an even larger dataset. We also increased redundancy and reliability thanks to high availability instances. Unlike our previous cloud provider, AlloyDB’s pricing was transparent and predictable, and we were never surprised with extra charges we didn’t expect. By creating a database cluster for each blockchain we support, we can isolate blockchains from each other, so our reliability has never been better. Most importantly, the faster write operations and lowered lag time between the writer and reader instances enabled queries much closer to real-time.

Now we can scale to more blockchains and more decentralized exchanges without worrying about slowing data delivery to our customers. In fact, since migrating to Google Cloud, we have boosted our platform’s response speed by 3x, reduced our costs by 60 percent, and we are confident we can support more transactions per second. We are now integrating four new decentralized exchanges and a blockchain. This allows institutional investors using FLUIDEFI® to diversify safely into decentralized finance.

Forging ahead with AlloyDB

Our service demands a high-performance database that can handle large volumes of data in real time. AlloyDB is critical to our success because it can store and process vast amounts of data, perform complex queries, and generate real-time insights that help investors and traders make informed decisions. Its advanced features, like high availability, scalability, and security, make it ideal to support our data processing and analytics needs. We see AlloyDB as an essential tool to achieve our vision — to capture a significant share of the rapidly growing DeFi market.

Read More for the details.