GCP – Commerzbank has Reimagined the Customer Experience with Google Contact Center AI

Digital channels and on-demand banking have led customers to expect instant and helpful access to managing their finances, with minimal friction. Google Cloud built Contact Center AI (CCAI) and DialogFlow CX to help banks and other enterprises deliver these services, replacing phone trees or sometimes confusing digital menus with intelligent chatbots that let customers interact conversationally, just as they would with human agents.

Leaders at Germany-based Commerzbank, which operates in over 50 countries, saw potential for these technologies to enhance customer experiences, providing more curated and helpful interactions that would build trust in and satisfaction with their brand. Commerzbank’s implementation speaks to how conversational artificial intelligence (AI) services can help businesses better serve customers, and in this article, we’ll explore their story and what their example means for your business.

Commerzbank: Disrupting Customer Interactions with Google’s Contact Center AI and Dialog Flow CX

Tokyo, 7:00 AM. Vanessa is on a business trip in Japan, closing a new deal for her company, one of Commerzbank´s more than 30,000 corporate customers throughout Germany. She has been preparing for weeks, and is going through her points a final time in a downtown coffee shop. Glancing at her watch, she realizes she must leave immediately to get to the meeting.

Intending to pay, she realizes the chip in her credit card is not functioning. Due to the time difference with Germany, Vanessa is now concerned she will not be able to contact someone from customer support. She opens the Commerzbank mobile app and contacts the customer center through chat. The access point she needs is available, but how can it help her most efficiently?

Building excellent conversational experiences

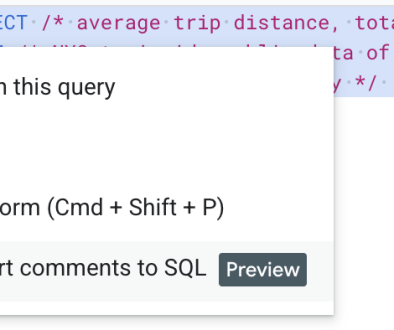

Customers like Vanessa need an answer right away. With that in mind, Commerzbank aims to provide customers with integrated support via the use of chatbots in the quest to deliver efficiency, high quality, and information consistency. This goal is where the Google Cloud virtual agent platform Dialogflow CX comes into play, providing us with an enormous number of features to build conversation dialogue through accurate intent recognition, a robust visual flow creator, and automated testing—all while significantly improving our time to market.

In just nine weeks, the Commerzbank team set-up an agile proof-of-value project by developing a chatbot solution designed to deliver a reliable conversation experience. Commerz Direktservices Chatbot Agent is now able to identify the touchpoint the customer is using (App or Web) and detect more than 100 suitable FAQs and answer them properly. The Chatbot Agent also identifies leads and sales prospects, enabling it to provide support on open questions in relation to products and services, thus performing a graceful handover to the human agent with the enrichment of value parameters. Commerz Direktservices has also broadened the ability of the Chatbot to handle different customer types (keyword-based vs. context-based customers) by constructing an intelligent dialog architecture that lets the Chatbot Agent flow elegantly through prompts and intent questioning.

Commerzbank has integrated Google Dialogflow CX with Genesys Platform, helping to make use of the full capabilities of the existing contact center infrastructure and more efficiently orchestrate the incoming interactions. A very versatile architecture bridges the potential of Google Cloud with a variety of on-premise applications and components, while also providing system resiliency and supporting data security compliance. The support of the entire Google team has been invaluable to accelerate the bank’s journey to the cloud. Commerzbank is seeing a number of benefits as it expands its AI platform, including:

Enhanced ability to deliver innovation

Improved operational efficiencies

Better customer experience through reduced wait times and self-serve capabilities, leading to reduced churn

Greater productivity for CommerzBank employees who are able to support customer queries with enriched Google CCAI data

The creation of an integrated cross-channel strategy

Going beyond support into an active conversational experience

Now, Commerzbank wants to move beyond great customer support to continue to increase the value-add to the customer. Customers like Vanessa are looking for their bank to go the extra mile by optimizing their finances, providing personalized financial products and solutions, and offering more control over their investment portfolio, among other needs. With this in mind, Commerzbank aims to continue moving away from a scenario where chatbots are only passive entities waiting to be triggered, into a new and more innovative one whereby they become an active key enabler of enhanced customer interactions across the customer value chain.

Commerzbank is already mapping active dialog paths to:

Make tailored product suggestions to prospects, giving them the possibility to acquire a product that suits their particular needs

Identify customer requirements for financing or investment, inviting them to get advice and benefit from the existing opportunities

Generate prospects based on the business potential, thus providing the human agents with a framework to prioritize their interactions

Commerzbank leaders anticipate the impact of this solution will be significant. It will let the company fulfill the first advisory touchpoint for financial needs and perform a fast conversation hand-over to specialists as soon as the customer requires it. As a result, leaders expect to exponentially increase conversion rates via more fruitful customer journeys.

Helping Vanessa with a delightful customer experience

Going back to Vanessa’s example: how can Commerzbank help Vanessa efficiently? When she contacts support through chat, the chatbot welcomes her and offers help with any question she may have. Vanessa explains the situation and the digital agent explains that delivering a replacement card would take many days, and that the most practical solution would be to activate a virtual debit card, e. g., with Google Pay on her phone. Vanessa gladly accepts this solution, prompting the Chatbot to deliver a short explanation on how to carry out the process, as well as two additional links: one for downloading the Google Pay App from the Google Play Store and another for digital self-service in the Commerzbank App, which she can intuitively use to synchronize the Commerzbank App and Google Pay. After just 5 minutes, Vanessa is able to pay comfortably using her phone and get to her meeting in time.

This engagement is how Commerzbank wants to deliver digital customer experiences that fascinate their customers, allowing their customers to perform their daily banking activities faster, better, and easier. To learn more about how Google Cloud AI solutions can help your company, visit the product page or check out this report that explores the total economic impact of Google Cloud CCAI.

Read More for the details.