GCP – How Resistant AI uses Document AI for fraud-resilient automated document processing

Moving from manual to automated document processing has been one of the great success stories of AI, removing countless hours of repetitive, error-prone manual labor, and freeing people up to focus on delivering real value. Google Cloud’s Document AI has been a key part of this success.

But new ways of taking in documents can expose organizations to various levels of risk and create new opportunities for fraud to occur, particularly in high-risk industries like financial services. Know Your Customer (KYC) and anti-money laundering (AML) regulations require these institutions to collect and process documents to understand their clients better. Automating those processes without adequate controls can instead increase their risk.

The risks for FinTechs are in particular very high, as introducing operational efficiencies like automation into their organization is usually a key organizational goal — but it also creates opportunities for various types of nefarious activities. A good example is organized criminals creating fake accounts which can lead to fraud and money laundering activities. This is why fraud resiliency is one of the biggest challenges for FinTech Product and Operational teams, particularly in the automation of customer onboarding.

Manual verification is incapable of identifying most forgeries in digital documents since they leave little-to-no visible traces. After processing tens of millions of documents, Resistant AI found that up to 17% of digital bank statements used for loan applications, account openings, and other purposes worldwide have been tampered with, and 15% of company registration certificates submitted worldwide when opening corporate bank accounts are fake. In addition, serial fraud attacks which rely on easy-to-find document templates provide a cheap way to scale attacks beyond human controls and create armies of throwaway accounts that can be used as synthetic money mules.

That’s why Resistant AI developed Document Forensics: an easy-to-deploy API that can automate document fraud checks to secure any workflow built with Google Cloud’s Document AI.

Automated document fraud checks

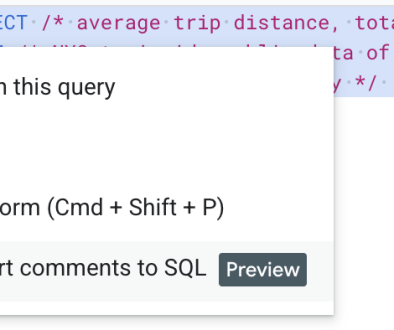

The core goal of Resistant AI’s Document Forensics is to provide a quick decision to accept, deny, or escalate a digital document for additional review. The submitted document is qualified, classified, and verified within seconds to speed up the review process, whether in PDF or image format, to ensure a seamless and easy experience.

Quality: Can you read the document? This step checks the documents to ensure they are of sufficient quality to be processed for Optical Character Recognition (OCR), and aren’t hiding fraud behind camera flashes, low resolution, image blurs or more. Causes of rejection can be used as feedback for customers to submit a new version.

Classification: Is it the right kind of document? This step ensures you only take in documents that meet your acceptance criteria. You shouldn’t be taking in and processing ID cards if all you’re looking for are utility bills.

Verification: Should you trust it? This step checks the document over 500 ways for signs of tampering. After individual analysis, it will compare all submitted documents — everything from metadata to the color temperature and scene composition — to find patterns of document reuse, template farms, and mass fraud attempts across accounts.

Together, these three steps make sure human intervention isn’t wasted on clear fraud cases which should be declined, or on documents that show no signs of tampering and which should be automatically processed by Google Cloud’s Document AI extraction. When a document is escalated for review, it is displayed in a user interface (UI) which makes every single finding that determined the verdict available to the reviewer so they spend less time making a decision.

Payoneer, a major international merchant services provider, was able to reduce manual document fraud reviews to just 18% of their intake, and their customer approval representatives agreed with the verdicts 99.2% of the time. In addition they’re now stopping hundreds of serial fraud attempts per day at onboarding.

Habito, the UK’s leading digital mortgage broker, was able to detect 32% in incremental fraud compared to their already existing fraud solutions, and reduce fraud investigations by 52 minutes per case.

How to bring Resistant AI Document Forensics and Google Cloud Document AI together

By operating in the same cloud, customers can expect to fully leverage the security and privacy standards they’ve come to expect from Google Cloud to apply to Resistant AI — speeding up procurement processes.

Document AI also goes beyond simply extracting data from documents, but enriches the result with the Google Knowledge Graph to check company names, addresses, phone numbers, and other details against entities on the internet.

Learn more about Resistant AI on Google Cloud here and check out their listing on Google Cloud Marketplace.

Read More for the details.